Bloomberg and Blackstone Prediction:

Alternative Assets Will Find Their Way into Your 401(k) Plans

Jeffrey Sweeney, Chairman and CEO at US Capital, discusses the strengths of alternative fixed-income investments and the opportunities they present to generate steady and higher interest rates, with reduced risk and increased long-term stability.

In looking for ways to mitigate the effects of rising inflation and weather the market’s ups and downs, more investors are turning to alternative assets such as real estate, private debt, and private equity. Alternative assets, especially alternative fixed-income investments, are distinct in their ability to reduce exposure to volatility and generate steady returns. Backed by salable assets, they generally have a low correlation to the stock market and the general economy and are largely undisturbed by share price fluctuations.

In looking for ways to mitigate the effects of rising inflation and weather the market’s ups and downs, more investors are turning to alternative assets such as real estate, private debt, and private equity. Alternative assets, especially alternative fixed-income investments, are distinct in their ability to reduce exposure to volatility and generate steady returns. Backed by salable assets, they generally have a low correlation to the stock market and the general economy and are largely undisturbed by share price fluctuations.

As a way to diversify a portfolio and earn returns generally uncorrelated with traditional financial markets, alternative investments were once seen as mainly the purview for large institutional investors or UHNW who do not require their assets to be liquid. But now many alternative assets are “semi-liquid,” with quarterly liquidity events for investors. This can make them attractive for appropriate retail investors seeking higher yields amid a decade of low interest rates and now high iflation.

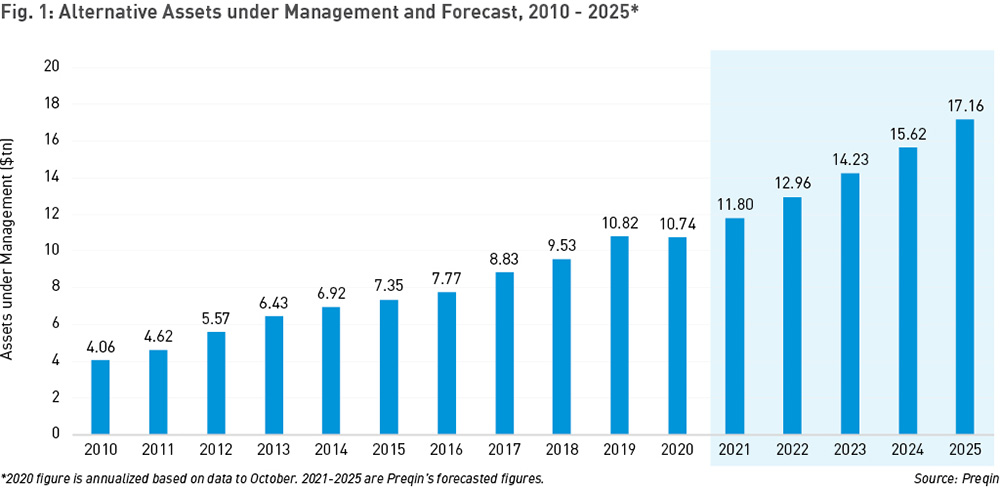

Retail investors are increasingly turning to alternatives, especially private credit. According to data provider Preqin, assets under management for the private-debt market roughly doubled over five years to more than $1 trillion in 202. Moreover, global assets under management in alternatives as a whole are set to increase by 60% between 2020 and 2025, far outpacing global GDP and inflation. The alts industry is expected to reach $14 trillion by 202, with private equity and private debt leading the way.

Financial advisers are increasingly steering individual investors into this burgeoning alts market. According to a recent Bloomberg article, Blackstone, the world’s largest private equity firm, recently predicted that alternative assets will eventually find their way into 401(k) plans. It is just a matter of time.

Higher interest rates through alternative fixed income investments

Expanding one’s portfolio into alternative fixed-income investments not only protects against interest rate losses but opens opportunities to participate in some of the generation’s greatest new businesses. As an eligible accredited investor, you can capitalize on opportunities through private alternative fixed-income investments that are not yet in the public markets but available directly from asset managers and registered broker-dealers like US Capital Global Securities or from the more progressive investment advisors we supply opportunities to for their clients.

US Capital Global Securities offers alternative fixed-income investments in a variety of sectors. Our banner investment vehicle, US Capital Global Lending LLC, provides senior secured, asset-backed credit facilities to lower middle-market businesses. The company has audited returns from 2021 of 8% per annum with quarterly liquidity. Metals House Inc. is a gold inventory and cash collateralized credit facility to support gold arbitrage trading. Metals House has been operating successfully for several years and pays an annual 8% rate of return at 2% per quarter, with a five-year lock up. US Capital Royal Eagle Green Energy Income Fund, LLC is a new fund offering 10% interest from investments into smaller green energy projects of high quality but just under the size institutional investors would participate in.

Investors sticking to traditional asset classes can be caught in a long-term low-interest-rate product when inflation springs up, as we see today. With the support of an investment bank skilled in due diligence and innovative investment advisors who allocate to these products, investors in fixed-income alternatives can respond to global changes as they arise while generating potentially higher gains than traditional investments.

What are the risks and rewards of alternatives?

Counterparty risk and underlying assets and cash flows are the primary drivers of risk in alternative fixed income. Before US Capital Global Securities considers distributing an alternative fixed-income offering, it conducts extensive due diligence to help ensure the management, assets, and cash flows are reliable and resilient, as stated in the offering materials.

Preferred alternative fixed-income investments typically have one or more of the following characteristics:

• Product sales in the marketplace with a diversified customer base

• Cash flow necessary to service debt

• Assets sufficient to liquidate in the event of default

• Adequate capital invested in the company or sponsors that will support the company

• Seasoned management team with sector expertise

Moreover, investors are able to mitigate their risk by investing in an alternative investment fixed-income fund, such as US Capital Global Lending LLC, thereby diversifying their investment across an array of industries and geographical regions.

Unlike publicly traded stocks, an alternative fixed-income credit fund’s performance is determined by the fund manager’s ability to assess the borrower’s credibility, rather than the state of the market that month or other factors unrelated to the company’s performance. This approach to determining an investment fund’s worthiness obviates the need to continually monitor comparative performance benchmarks and allows one instead to focus on seeking absolute returns, i.e., making a steady income in all market environments.

Jeffrey Sweeney is a fund manager with years of experience in corporate finance and asset management. He is Chairman and CEO at US Capital (www.uscapital.com), a full-service global private financial group headquartered in San Francisco, with primary offices in Las Vegas, Miami, London, and Milan.

Securities offered through US Capital Global Securities, LLC (“USCGS”), member FINRA/SIPC. This is for your information only and is not an offer to sell, or a solicitation of an offer to buy any securities or instruments. Any such offer or solicitation shall be made only pursuant to the confidential private placement memorandum and supporting documents, as amended or supplemented from time to time. The information has been obtained or derived from sources believed by us to be reliable, but we do not represent that it is accurate, complete, or timely. Any opinions or estimates contained in this information constitute our judgment as of this date and are subject to change without notice. USCGS or its affiliates may provide advice to, be compensated by, or hold debt or equity positions in the companies noted herein. View USCGS’ Form CRS at https://www.uscapglobalsecurities.com/crs.html. 05052022-VG

![]() Download a PDF of this Press Release

Download a PDF of this Press Release